Connect Sales

During this six-month-long project, I worked directly with senior leadership and six different product managers to envision a next-generation CRM tailored for Google's vast, organically grown, and notoriously complex management chain.

About sales platform & our users

Before diving in, let's set the stage with a quick primer on Google's sales ecosystem.

Team

- Customer Engagement — Responsible for Google's suite of customer-facing products, including Google Support and Google Ads lifecycle tools.

- Sales Platform — Develops tools for Google's business organization, supporting the multi-billion-dollar Ads business.

- Connect Sales a.k.a Greentea — An ad sales intelligence platform focused on customer success, sales productivity, and keeping sales teams happy (or at least less stressed).

Users

- Google Business Organization — The 20,000+ Ads sellers at Google, spanning large accounts, small businesses, agencies, and publishers.

Glossary: A quick sales jargon cheat sheet

- Seller or Frontline sellers — Googlers in the GBO org selling Google Ad products. (Think: Account Managers, Account Executives.)

- Client or Company or Customer — External businesses spending money to run ads on Google platforms. (e.g., Disney, BestBuy, Expedia.)

- LCS — Handles Google's biggest clients. (Think: Amazon, Booking.com.)

- GCS or Scaled — Focuses on smaller and long-tail customers, often remotely. (e.g., University of North Texas, Ducati.)

- GBO — Google's sales and marketing powerhouse.

Background: A CRM built for scale, but not for everyone

Greentea was initially built with frontline sellers in mind, achieving a solid 70% CSAT (Customer Satisfaction Score).

But managers? Not so much. Their CSAT sat at a sad 55%, meaning there was huge room for improvement.

Managers needed a tool that worked for their specific needs—tracking performance, analyzing trends, and making data-driven decisions—without spending hours sifting through outdated reports.

The pain points: What's broken?

- No high-level visibility — Managers had to manually track their entire book of business.

- Outdated reporting — They relied on static reports or decks updated weekly, making real-time decisions impossible.

- Lack of a single source of truth — Sales leaders needed a consolidated view of both LCS and GCS, which didn't exist.

The Goal: A smarter, future-proof CRM

We set out to build a personalized CRM designed to last 10+ years and serve all levels of Google's sales management chain.

What success looks like:

- Give leadership a bird's-eye view of their entire book of business.

- Help managers instantly identify areas that need attention.

- Enable deeper analysis at every level of the organization.

Project structure: Divide & Conquer

Since we were re-imagining the entire experience, we divided the work into specialized tracks:

- UX Infrastructure — Built scalable components like the Role Picker and Territory Switcher.

- Overview — A visual summary that highlights weak areas in the business.

- Portfolio — A deep-dive into all key sales metrics.

- Pipeline — An aggregated view of the sales pipeline, forecasting revenue flows.

- Reporting — A self-serve reporting tool that pulls data across different metrics.

- People — A way for managers to track team performance.

Research: Building with real users

To make sure we were solving real problems, we used a hands-on research approach:

- Weekly sessions with an Advisory Board — A group of managers worldwide provided ongoing feedback.

- In-person interviews — We sat down with managers to understand their pain points.

- F.A.S.T. Methodology — We used the Focus, Attend, Summarize, Translate (FAST) approach to quickly iterate on designs.

Our design principles

- Incorporate momentum — Managers require the ability to track the progression of key business metrics over time. The trajectory is needed both to contextualize and evaluate the impact of coaching and interventions.

- Highlight softness in the business — When a key business metric is under performing, support managers in localizing drivers by territory and product.

- Intuitive guided interpretation — Be sensitive to the complexity of having a wide variety of data/metrics available on a single view. Aid users via logical organization and grouping of cards. Provide cues on how card groupings relate to business use cases.

- Highlights and low lights, not lists — Utilize an overview to capture the top drivers for a given use case/question. Not appropriate for displaying complete lists of entities.

- Multiple levels of progressive disclosure — Employ hover interaction to further contextualize data visualizations. A deep link pattern supports navigation to entity summary and detail pages.

- Unfettered access to your territory — Provide managers with a complete view of what they're responsible for. Incorporate navigation patterns that support quick navigation through the territory hierarchy.

Design criteria: Guardrails for success

Based on the high-level principles we have distilled and complained a more similar list of guard rails.

- Focus on “toothbrush” use cases — Features should be used daily, not just for quarterly reports.

- Borrow from existing design language — Consistency with Google's other tools.

- Simplify complex data — Use visualizations over raw tables.

- Fast insights — Users should get a 3-5 min overview, not a 30-min deep dive.

- Highlight trends — Use color and movement to indicate soft spots in the business.

- Recursive design — Users should be able to drill down seamlessly.

Toothbrush tasks: What managers need to know daily

Target

- How does performance look across my territory?

- How am I pacing towards my revenue target?

- How am I pacing towards product metric targets?

In quarter pacing

- How is revenue tracking through the quarter?

- How is outlook tracking through the quarter?

Gap to target

- Where are the largest gaps in my territory?

- Which teams are contributing the most to the gap?

- Which companies are contributing the most to the gap?

Weekly performance change

- Which teams are driving weekly performance changes?

- Which companies are driving weekly performance changes?

Pipeline

- Do we have enough pipeline?

- How is the pipeline progressing?

Sales rigor

- How am I pacing towards sales activity targets?

Design showcase: The final product

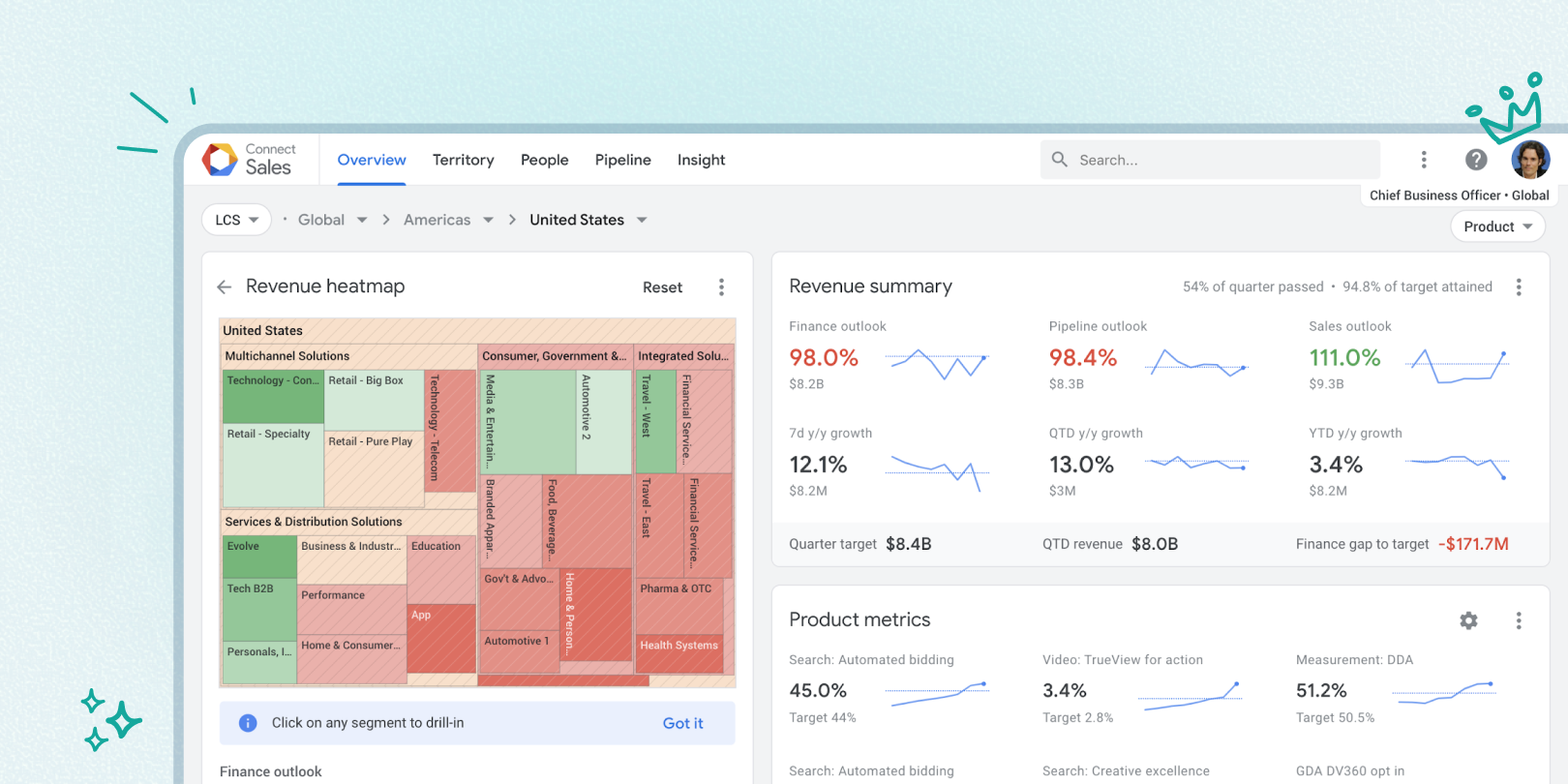

Each feature was designed to answer critical questions at a glance.

🧐 Where are my strongest & weakest performers?

At a glance, I can identify the lowest/highest performers by a metric of interest (showing Finance outlook) and determine if softness is localized or distributed across many nodes. Heat map provides contextual navigation allowing managers to drill into nodes of interest.

Tooltip showing information about hovered segment. The Tooltip persists when the user moves the cursor over it, supporting highlighting + copying of data.

📊 How am I pacing toward my revenue target?

As a manager, I can see a snapshot of attainment towards the target, outlook projections, and growth rates. Trend lines add a dimension of momentum, allowing me to see how metrics are progressing through the quarter.

How am I pacing toward my product metric targets?

As a manager, I can see a snapshot of attainment towards target plus progression through the quarter. As with the current overview product metric card, the specific metrics shown can be customized by the user.

How is revenue tracking through the quarter?

As a manager, I can get a weekly pulse of revenue attainment. The inclusion of last year's values provides additional data points to contextualize performance/growth. e.g Date range: Current quarter, Granularity: weekly or daily

How is outlook tracking through the quarter?

As a manager, I can evaluate pacing towards product-level targets (search, display, video). Daily values contextualize momentum through the quarter.

By using the card controls I switch to a view that lets me triangulate, comparing the three outlook metrics. As we progress through the quarter, I expect and look for alignment between the metrics.

Time range: Current quarter, Each data point is one day

Do we have enough pipeline?

As a manager I can validate that pipeline has been sufficiently built to meet target Breakout by stage enables me to understand the contribution of ASO vs. new incremental revenue.

Default: Breakdown by N-1. (Clicking on each N-1 row, it will navigate to that level, and break down the pipeline further to N-2.)

Drop-down option: Breakdown by-products

Final thoughts

With Connect Sales (a.k.a Greentea), Google's sales leadership now has a scalable, intuitive CRM built to handle decades of growth.

Managers get real-time insights, better decision-making tools, and less time wasted on outdated reports—all in an experience designed to scale with Google's sales teams for years to come.

Now, if only we could get our personal inboxes as organized as this CRM.